|

| BIR Form 0605 |

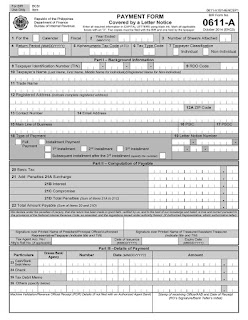

BIR Form 0605

Payment Form

This form is to be accomplished every time a taxpayer pays taxes and fees which do not require the use of a tax return such as second installment payment for income tax, deficiency tax, delinquency tax, registration fees, penalties, advance payments, deposits, installment payments, etc.

When to File?

This form shall be accomplished:

1. Every time a tax payment or penalty is due or an advance payment is made;

2. Upon receipt of a demand letter / assessment notice and/or collection letter from the BIR; and

3. Upon payment of annual registration fee for a new business and for renewals on or before January 31 of every year.

When to File?

1. Every time a tax payment or penalty is due or an advance payment is made;

2. Upon receipt of a demand letter / assessment notice and/or collection letter from the BIR; and

3. Upon payment of annual registration fee for a new business and for renewals on or before January 31 of every year.