|

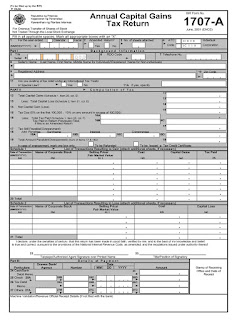

| BIR Form 1707-A |

BIR Form 1707-A

Annual Capital Gains Tax Return for Onerous Transfer of Shares of Stock Not Traded Through the Local Stock Exchange

This return is filed by every natural or juridical person, resident or non-resident, who is not exempt under existing laws for sale, barter, exchange or other disposition of shares of stock in a domestic corporation, classified as capital assets, not traded through the local stock exchange.

When to File?

- For individual taxpayers, this final consolidated return is filed on or before April 15 of each year covering all stock transactions of the preceding taxable year.

- For corporate taxpayers, this form is filed on or before the fifteenth (15th) day of the fourth (4th) month following the close of the taxable year covering all transactions of the preceding taxable year.

When to File?

- For corporate taxpayers, this form is filed on or before the fifteenth (15th) day of the fourth (4th) month following the close of the taxable year covering all transactions of the preceding taxable year.

No comments:

Post a Comment