|

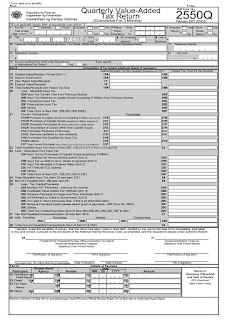

| BIR Form 2550Q |

BIR Form 2550Q

Quarterly Value-Added Tax Return

This return/declaration shall be filed in triplicate by the following taxpayers;

1. A VAT-registered person; and

2. A person required to register as a VAT taxpayer but failed to register.

This return/declaration must be filed by the aforementioned taxpayers for as long as the VAT registration has not yet been cancelled, even if there is no taxable transaction during the month or the aggregate sales/receipts for any 12-month period did not exceed the P1,500,000.00 threshold.

When to File?

This return is filed not later than the 25th day following the close of each taxable quarter. The term "taxable quarter" shall mean the quarter that is synchronized to the income tax quarter of the taxpayer (i.e. Calendar quarter of Fiscal Quarter)

1. A VAT-registered person; and

2. A person required to register as a VAT taxpayer but failed to register.

This return/declaration must be filed by the aforementioned taxpayers for as long as the VAT registration has not yet been cancelled, even if there is no taxable transaction during the month or the aggregate sales/receipts for any 12-month period did not exceed the P1,500,000.00 threshold.

No comments:

Post a Comment