|

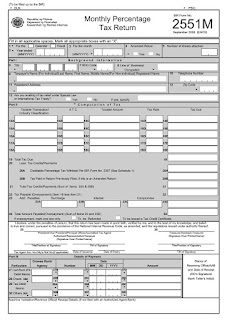

| BIR Form 2551M |

BIR Form 2551M

Monthly Percentage Tax Return

This return shall be filed in triplicate by the following:

1. Persons whose gross annual sales and/or receipt do not exceed P1,500,000 and who are not VAT-registered persons;

2. Domestic carriers and keepers of garages, except owners of bancas and owners of animal-drawn two wheeled vehicle;

3. Operators of international air and shipping carriers doing business in the Philippines;

4. Franchise grantees of gas or water utilities;

5. Franchise grantees of radio and/or television broadcasting companies whose gross annual receipts of the preceding year do not exceed Ten Million Pesos (P10,000,000.00) and did opt to register as VAT taxpayers;

6. Banks, non-bank financial intermediaries and finance companies;

7. Life insurance companies;and

8. Agent of foreign insurance companies.

When to File?

The return shall be filed not later than the 20th day following the end of each month.

1. Persons whose gross annual sales and/or receipt do not exceed P1,500,000 and who are not VAT-registered persons;

2. Domestic carriers and keepers of garages, except owners of bancas and owners of animal-drawn two wheeled vehicle;

3. Operators of international air and shipping carriers doing business in the Philippines;

4. Franchise grantees of gas or water utilities;

5. Franchise grantees of radio and/or television broadcasting companies whose gross annual receipts of the preceding year do not exceed Ten Million Pesos (P10,000,000.00) and did opt to register as VAT taxpayers;

6. Banks, non-bank financial intermediaries and finance companies;

7. Life insurance companies;and

8. Agent of foreign insurance companies.

No comments:

Post a Comment