|

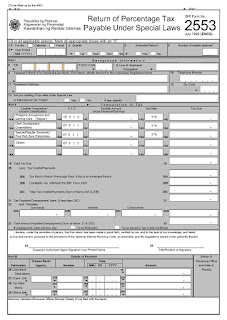

| BIR Form 2552 |

BIR Form 2552

Percentage Tax Return for Transactions Involving Shares of Stock Listed and Traded Through The Local Stock Exchange or Thru Initial and/or Secondary Public Offering

This return is filed by the following taxpayers:

1. Every stock broker, who effected a sale, exchange or other disposition of shares of stock listed and traded through the Local Stock Exchange (LSE) other than the sale by a dealer in securities, subject to a tax rate of one-half of one percent (1/2 of 1%) of the gross selling price or gross value in money of the stock sold, bartered or exchanged or otherwise disposed, which tax shall be shouldered by the seller/ transferor.

2. A corporate issuer, engaged in the sale, exchange or other disposition through Initial Public Offering (IPO) of shares of stock in closely-held corporations at the rates provided hereunder based on the gross selling price or gross value in money of the shares of stock sold, bartered, exchanged or otherwise disposed in accordance with the proportion of shares of stock sold, bartered, exchanged or otherwise disposed to the total outstanding shares of stock after the listing in the local stock exchange: Up to 25% = 4%; Over 25% but not over 33 1/3% = 2%; Over 33 1/3% = 1%.

3. A stock broker who effected a sale, exchange or other disposiiton through secondary public offering of shares of stock in closely held corporations at the rates provided hereunder based on the gross selling price or gross value in money of the shares of stock sold, bartered, exchanged or otherwise disposed in accordance with the proportion of shares of stock sold, bartered, exchanged or otherwise disposed to the total outstanding shares of stock after the listing in the local stock exchange: Up to 25% = 4%; Over 25% but not over 33 1/3% = 2%; Over 33 1/3% = 1%.

When to File?

This return is filed as follows:

a. For tax on sale of shares of stock listed and traded through the Local Stock Exchange (LSE), within five (5) banking days from date of collection;

b. For shares of stocks sold or exchanged through primary Public Offering, within thirty (30) days from date of listing of shares of stock in the LSE; and

c. For tax on shares of stock sold or exchanged through secondary public offering, within five (5) banking days from date of collection.